The Africa Continental Free Trade Area: Benefits, Costs and Implications

African leaders from 44 African nations gathered at the African Union Summit from March 17th to 21st 2018 in Kigali, Rwanda, and signed the Continental Free Trade Area (AfCFTA) treaty to create the world’s largest single market. The agreement will be the largest trade agreement in history since the creation of the World Trade Organization. (1)

The pact aims to boost intra-African trade by making Africa a single market of 1.2 billion people and a cumulative GDP over $3.4 trillion. The UN Economic Commission for Africa (UNECA) estimates that the implementation of the agreement could increase intra-African trade by 52% by 2022 (compared with trade levels in 2010) and double the share of intra-African trade (currently around 13% of Africa’s exports) by the start of the next decade. (2) (8)

Among the AU member states that did not sign the pact are the continent’s two largest economies – Nigeria and South Africa. Botswana, Lesotho, Namibia, Zambia, Burundi, Eritrea, Benin, Sierra Leone and Guinea Bissau are the other member countries which did not sign the pact. (1) (3) (4) Under the CFTA, governments commit to removing tariffs on 90% of goods produced within the continent. The next step for the governments is to ratify the CFTA in their countries within the next 6 months. (1)

Objectives of the Continental Free Trade Area

- Establish a single continental market for goods and services, with free movement of business professionals and investments, accelerating the establishment of the Continental Customs Union and the African customs union. (5)

- Expand intra-African trade through better harmonization and coordination of trade liberalization and facilitation across Regional Economic Communities (RECs) and across Africa.(5)

- Resolve the challenges of multiple and overlapping memberships and expedite the integration processes.(5)

- Enhance competitiveness at the industry and enterprise level by exploiting opportunities for scale production, continental market access and better reallocation of resources. (5)

Potential Benefits & Relevant Implications

According to a research paper published by the United Nations Conference on Trade and Development (UNCTAD) in February 2018, the CFTA offers many opportunities for sustainable development and economic growth in the African economies. However, not all countries will benefit to the same extent, and the gain of welfare benefits also implicates relevant costs and commitments. (6)

Most of the benefits of further trade integration (i.e. welfare benefits from lower import prices, production efficiency and increase in outputs, higher value-added jobs and exports, technological specialization, etc.) will materialize in the long term, while most of the associated costs of adjustment and integration (i.e. loss in trade tariff revenue, local SME’s vanishing in front of stronger competition, adjusting unemployment, required investment in infrastructure, political and regulatory reforms, etc.) will be incurred in the short term. (6)

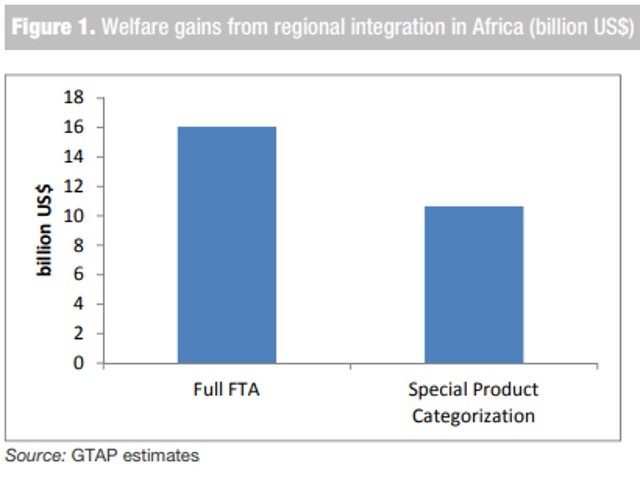

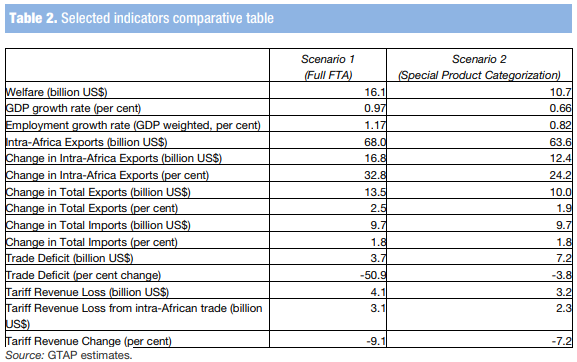

Using the Global Trade Analysis Project (GTAP) computable general equilibrium (CGE) model, UNCTAD has estimated the quantitative effects of the CFTA according to 2 long-term scenarios: a full Free Trade Agreement (FTA) and Special Product Categorization (SPC). (6)

A full Free Trade Agreement (FTA) eliminating all tariffs in the CFTA could generate welfare gains of US$ 16.1 billion, at the cost of US$ 4.1 billion in trade revenue losses (representing 9.1% of current tariff revenues). GDP and employment are expected to grow by 0.97% and 1.17% respectively. Intra-African trade growth is estimated at 33% and the continent’s trade deficit is expected to drop by 50.9%. (6)

Special Product Categorization (SPC) permanently exempts sensitive products from liberalization. In a scenario in which the sector with the highest current tariff revenue would be exempted from liberalization, UNCTAD simulations estimate a welfare gain of US$ 10.7 billion in the long term. Tariff revenue losses are expected at US$ 3.2 billion (representing 7.2% of current tariff revenues). GDP and employment growth are expected to grow by 0.66% and 0.82% respectively. Intra-African trade is expected to grow by 24%, while, Africa’s trade deficit only shrinks by 3.8%. (6)

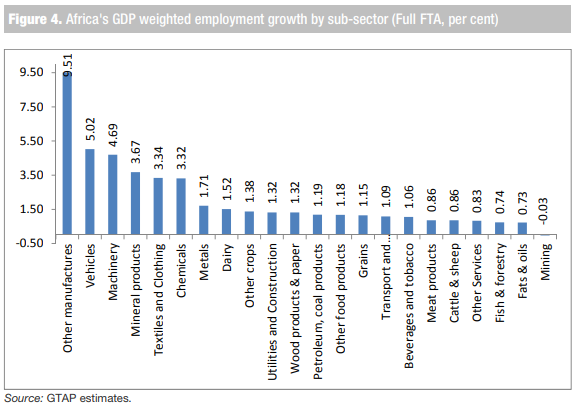

UNCTAD also estimates the employment effect of the agreement by sub-sector (Figure 4).

The agriculture sector is extremely relevant for the African economies since it employed about 53% of the continent’s labor force in 2016. Governments are worried about possible adverse impacts of the CFTA on the agriculture sector’s economic growth, which would massively affect employment across the continent. Even though the largest employment growth rates are found in manufacturing and services sectors, agriculture sub-sectors are also expected to grow (see Figure 4).(6)

Costs & Commitments

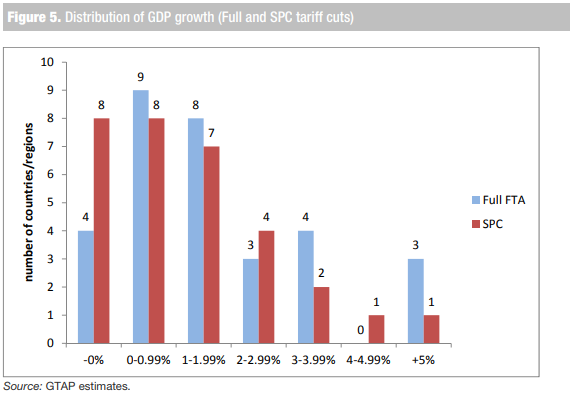

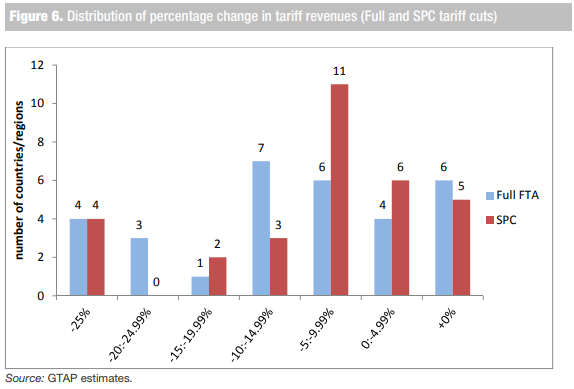

Despite the many benefits this agreement will render, not all the countries are expected to benefit equally from the free trade agreement. While expected average GDP growth is around 1%, some countries are expected to grow over 3%, while some others are expected to contract (Figure 5). Figure 6 shows that, under the SPC scenario, fewer countries suffer tariff revenue losses above 20% compared to the full FTA scenario. (6)

It is vital that African countries commit to continue improving their institutional capacities to efficiently tax and redistribute the gains from the CFTA. This includes integrating and harmonizing regulatory measures, eliminating non-tariff barriers to trade and investment, and facilitating the entry into the formal economy. (6) (8)

Another key factor to fully exploit the potential benefits of the CFTA is infrastructure. Addressing Africa’s physical infrastructure gap will require $93 billion per year worth of public and private investment. (8)

Even though African exports to the world are undiversified and mostly composed of raw materials, Intra-Africa exports (exports between African countries) contain more value-added products. (7)

Even though African exports to the world are undiversified and mostly composed of raw materials, Intra-Africa exports (exports between African countries) contain more value-added products. (7)

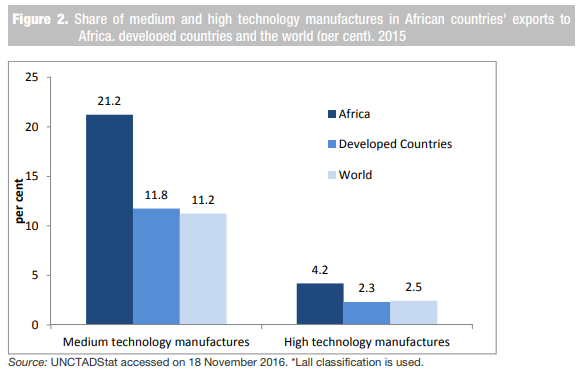

Manufactured goods represented 43% of intra-Africa exports during 2012-2016, while only representing 20% of exports to the rest of the world. Medium and high technology manufactures represented 25.4% of intra-African trade in 2015, but only accounted for 14.1% of Africa’s exports to developed countries and 13.7% of the continent’s exports to the world (Figure 2). (6) (8)

As such, countries with large manufacturing bases and enabling physical and industrial infrastructure, such as South Africa, Kenya, Egypt, Morocco, and Ethiopia are in a better position to gain the expected benefits of the CFTA. (7)

Agriculture will also benefit from the creation of a more viable African marketplace for food. Enhanced trade in agricultural products will also promote agro-processing and further sectoral linkages with manufacturing. (8)

Even though the CFTA is a great step forward towards economic integration, there is still a long road ahead. African governments must commit to keep working so that the gains from the CFTA are distributed as fairly as possible, making sure no one is left behind, and ensuring that the CFTA becomes a catalyst for sustainable economic development for the continent as a whole. (8)

Jesús Cazares, Analyst at Infomineo.

Sources

- https://www.businessdailyafrica.com/news/Africa-leaders-ink-largest-free-market-treaty/539546-4351888-ubv411z/index.html

- https://www.aljazeera.com/news/2018/03/african-continental-free-trade-area-afcfta-180317191954318.html

- https://edition.cnn.com/2018/03/22/africa/african-trade-agreement-world/index.html

- https://www.reuters.com/article/us-africa-trade/nigeria-keen-to-ensure-africa-trade-bloc-good-for-itself-president-idUSKBN1GX29V

- https://au.int/en/ti/cfta/about

- http://unctad.org/en/PublicationsLibrary/ser-rp-2017d15_en.pdf

- https://www.moodys.com/research/Moodys-African-free-trade-deal-could-improve-regions-credit-profiles–PR_381153

- https://www.weforum.org/agenda/2016/05/this-african-trade-deal-could-improve-lives-across-the-whole-continent/

You may also like

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235