How the Global 500 are organizing themselves in the Middle East and Africa

Highlights from this year’s Organizing for Growth Report

For over 25 years the American Fortune magazine publishes an annual list of the top Global 500 companies ranked by revenue. The companies that made the list in 2017 generated a combined revenue of 27.7 trillion USD — roughly 37% of global GDP –, earned profits of 1.5 trillion USD, and employed 67 million people. ((Fortune. “Global 500.” http://fortune.com/global500/ (last accessed: April 4, 2018).))Fortune’s list is not only “global” in the sense that it represents businesses from 34 different countries, but also because many of them are offering their respective goods and services across the globe. Infomineo’s third annual review of the Global 500 attempts to provide information concerning the corporate structure of companies on the list. The objective of the study is to understand how major global corporations are conducting business in the Middle East and Africa and what are the most favorite destinations for foreign entities to set up a regional headquarter (RHQ)((Defined by a cluster of management level positions within a certain location that indicate a decision-making responsibility regarding wide-ranging strategic decision concerning the Middle East, Africa, or the entire MEA region.)) or a sub-regional headquarter (SRHQ).((SRHQs have limited decision making responsibilities confined to specific areas such as marketing or human resources.))

Dubai, the city upon a hill

Dubai and Johannesburg are once again the top destinations for foreign entities when it comes to the number of regional headquarters. Dubai is hosting 155 regional and sub-regional headquarters that are overseeing business activity in either the Middle East or the entire MEA region.

The most attractive city in Africa remains Johannesburg, which has a combined 29 regional headquarters.((28 regional headquarters covering Africa, and 1 covering the entire MEA region.)) Additionally, 46 companies decided to oversee their southern African business activities out of South Africa’s biggest city.

On the other side of the continent, Casablanca is once again the most attractive hub to cover North Africa, whereas companies with a lot of business in east Africa prefer to set up their regional presence in Nairobi. While Lagos remains the most desirable hub for entire west Africa, Abidjan is gaining momentum as a sub-regional headquarter overseeing francophone Africa.

Europe, a bridge to the MEA region

On a company’s way to the MEA region, Europe seems to play an important bridge function. As of 2017, a total of 63 companies are overseeing their MEA operations from Europe. In most of these cases, companies from either Asia or North America are setting up regional headquarters in Europe to cover the geographical area called EMEA – Europe, Middle East, and Africa. London remains the most desirable hub for foreign entities in Europe with 26 regional headquarters. The British capital seems to be particularly attractive to U.S. companies((out of the 26 companies with an EMEA RHQ in London, 12 are American)) and to financial institutions ((Out of the 26 companies with an EMEA RHQ in London, 12 are from the financial services sector)). Even though some financial institutions such as JPMorgan Chase, Bank of America, and Goldman Sachs, have already announced that they are expanding their offices in Frankfurt and Paris,((Keohance, David. “Goldman Sachs confirms Frankfurt and Paris hubs after Brexit.” Financial Times. November 20, 2017. Jones, Huw. “Paris neck-and-neck with Frankfurt in Brexit Race.” Reuters. February 18,2018.)) it is too early to estimate the possible impact the U.K.’s departure from the European Union might have on London’s attractiveness.

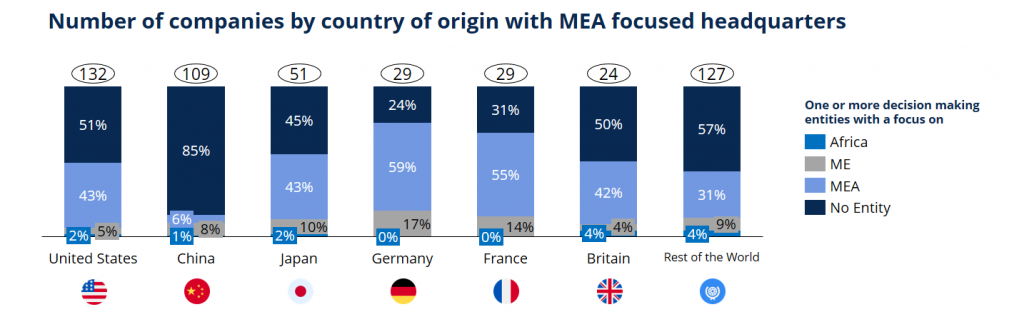

Chinese companies maintain centralized decision centers

Looking at the country of origin of the companies reveals one of the most remarkable insights in this year’s Global 500 review. Chinese companies, despite vast business interests in MEA, are the least likely to have a regional or sub-regional headquarter in the region. Even as corporations are setting up small, local branch offices, the centralized decision center remains in the main headquarter in China. Only 15 percent of Chinese companies have a dedicated regional headquarter for the Middle East or Africa, compared to 49 percent for the U.S. and 55% for Japan.

Number of companies by country of origin with MEA focused headquarters

Tech companies on the rise

Facebook, Alibaba, or Tencent are not only prominent newcomers on Fortune’s 2017 list but a vivid illustration of the global rise of technology companies in the 21st century. With now 44 companies on the Global 500, technology became the third biggest sector on the list behind financial services and energy. Tech companies are simultaneously increasing their revenues globally and expanding their presence regionally. In 2017, 33 companies in the technology sector had a dedicated RHQ covering the MEA region, compared to 22 companies the previous year.

Kevin Matthees, Associate at Infomineo.

You may also like

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235