Wealth Management in GCC countries in the wake of COVID-19

While it is still early to estimate the damage of COVID-19 on economies, economists’ early estimates suggest a big negative short-term impact for countries. It is, without a doubt, the lockdown measures implemented by many countries had put global economies in the disruption.

In certain economies, the impact is doubled. GCC countries, for instance, are experiencing dual shock from the pandemic: the economic shutdown and the collapse in global oil prices.

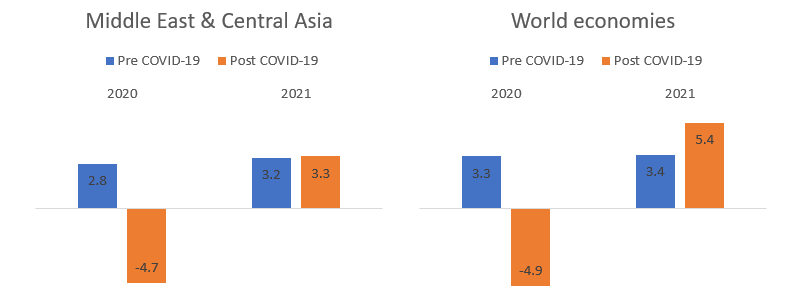

The International Monetary Fund (IMF) (1 & 2) latest June report projects the economic outlook for the Middle East and Central Asia region to be negative at -4.7% by the end of 2020 but is expecting it to rebound in 2020 to be 3.3% growth as the economic activity is expected to slowly normalize. This has changed from its initial pre-COVID-19 crisis when the IMF projected a 2.8% increase of real GDP in 2020.

Figure 1: Real GDP Growth

The Pandemic had also a deep impact on oil prices. GCC countries’ revenues rely mainly on Oil. But this latter has reached an unprecedented price level. According to PWC (3), if Oil prices are sustained at $20 per barrel for the rest of 2020, GCC countries can lose $554 million per day.

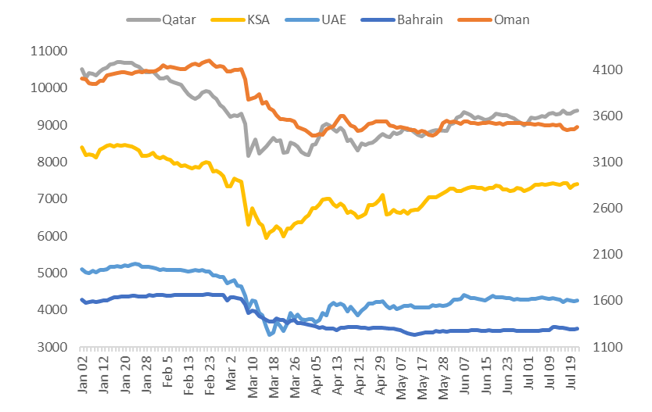

The stock market in Gulf countries also has witnessed high volatility over the past few months. As figure 2 shows, the daily prices of indices have reached a maximum drop value for all GCC countries starting the beginning of March 2020 and started to recover again slowly. The following are the YTD of GCC indices (as of July 21st):

– UAE ADX General: -16.5%

– KSA Tadawul All Share: -11.3%

– Bahrain All Share: -19.2%

– Oman MSM 30: -13.1%

– Qatar QE General: -10.6%

Figure 2: GCC countries Market indices performance

The combined effects of these macroeconomic indicators have the wealth management sector in a new delicate environment. As the revenue streams of managers depend heavily on the performance of the equity market, market volatility causes a decline in assets and therefore a decrease in management fees. Moreover, most Sovereign Wealth Funds (SWFs) in GCC are oil-based, which means they depend heavily on prices of oil.

However, over the years, wealth management has proven to be robust through crises such as the global financial crisis in 2008 and the European sovereign debt crisis in 2010. According to a BCG study (4), over the last 20 years, personal financial wealth in growth markets which consist of Africa, Asia excluding Japan, Latin America, Eastern Europe, and the Middle East, has sped up to reach 25.3% of global wealth in 2019 vs. 17.3% in 2009 and 9.3% only in 1999. This is due to strong GDP performance and higher rates of individual savings. In the middle East alone, wealth has increased by 7.4% over the past 20 years to reach 4.2 Trillion USD in 2019.

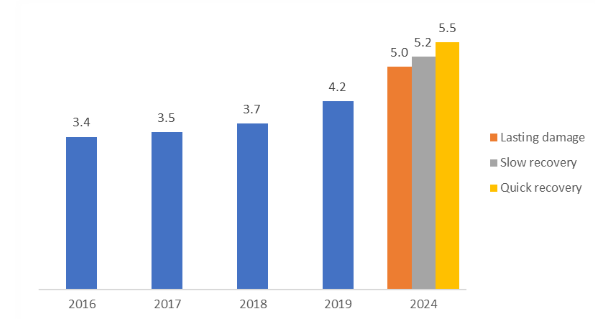

As a short-run effect of COVID-19 on wealth managers, wealth will see a decrease in value in 2020 but will rebound after based on 3 scenarios projected by BCG. In the case of a quick economic recovery, Middle Eastern wealth will increase by 5.6% in the next 5 years to hit 5.5 Trillion USD, 4.3% growth in case of slow recovery to 5.2 Trillion USD, and 3.4% under a lasting damage scenario to reach 5 Trillion USD by 2024. Last year’s estimates from BCG suggested that wealth in the Middle East will grow by a CAGR of 6.9% between 2018 and 2023.

Figure 3: Forecasted wealth in the Middle East

Another study by Oliver Wyman and Morgan Stanley (5) expects the funds under management in the Middle East & Africa to increase by 6% annually for the next 5 years. Assets of High Net Worth wealth in the region will fall by 5% in the short term before rebounding to 5% by 2024. The report said that the pandemic will have a negative impact on the asset performance because of anticipated bankruptcies and muted executive pays, which will impair the overall net interest income.

Overall, the wealth management industry has shown resilience through a historical crisis and is likely to survive the COVID-19 crisis as well. However, wealth managers should think about new ways to serve their clients. They should be vigilant and undertake more reactive approaches to stay competitive in the long run. They will need also to re-examine their operating model and adopt agile ways of working since the rivalry from technological advances will likely intensify.

Fadwa Khalil – Senior Associate

Sources:

https://www.imf.org/en/Publications/WEO/Issues/2020/01/20/weo-update-january2020

https://www.imf.org/~/media/Files/Publications/WEO/2020/Update/June/English/WEOENG202006.ashx?la=en

https://www.strategyand.pwc.com/m1/en/covid-19-oil-price-drop-gcc.html

https://image-src.bcg.com/Images/BCG-Global-Wealth-2020-Jun-2020_tcm9-251066.pdf

You may also like

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235