The growing need for common ESG standards and regulations: The case of the Asset Management industry

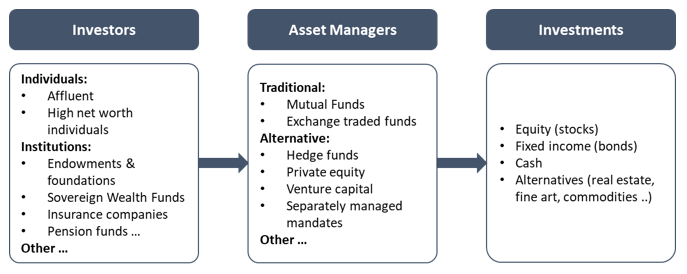

Environmental Social and Governance (ESG) investing has taken the center stage in finance. Investors have been increasingly pouring money into ESG funds, and asset managers have taken notice and responded to this trend by embracing ESG factors within their strategies to attract more inflows, balancing ESG requirements with traditional risk and reward considerations.

Despite a lack of legal requirements from policy makers, stakeholders, both individual and institutional, have been seeking greater clarity regarding the impact of their contributions. They are keen to understand not only “if” asset managers are committing to ESG, but proactively asking questions about managers’ stewardship approach.

With the current increased interest in ESG, it is important to understand what is ESG investing and what are the gaps in regulations that govern ESG stewardship and reporting?

ESG stands for Environmental Social and Governance and refers to the three key factors when measuring the sustainability and ethical impact of an investment. Environmental factors include climate change, greenhouse gas emission, waste, pollution etc. Social include human rights, labor practices, talent management, product safety and data security. Governance refers to a set of rules or principles defining rights, responsibilities, and expectations between different stakeholders in the governance of corporations like board diversity, executive pay, and business ethics.

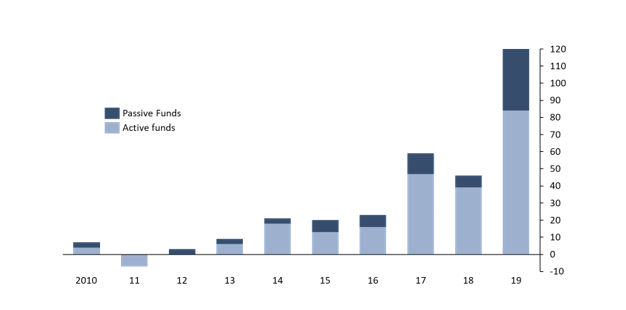

The year 2019 has been a memorable one for ESG investments as it saw a significant jump in sustainable fund flows. In the US, for instance, investors poured a record $21 billion into socially responsible investment funds, almost quadrupling the rate of inflows in 2018. In Europe, sustainable fund flows reached €120 billion in 2019, nearly triple the previous year’s amount which stood at €44.8 billion.

To illustrate ESG’s rising popularity among investors, Legal & General Investment Management “LGIM”, the UK’s largest asset manager with £ 1.2 trillion under management*, has more than doubled its business in 2019 due to its excellent ESG track record. The company’s assets under managements were boosted by a £37 billion mandate from the Government Pension Investment Fund of Japan, the world’s largest retirement scheme (more than $1.5 trillion in assets*) and a vocal advocate of responsible investing. LGIM’s CEO Nigel Wilson stated: “ESG is really contributing to our success… the brand is travelling very well.”

While the degree to which asset managers have embraced this responsibility varies widely, we see growing evidence that some are taking this role seriously and using their influence to encourage greater sustainability. For instance, in 2019, BlackRock, the biggest money management firm in the world with more than $7 trillion under management*, announced its intention to start divesting from companies that get more than 25% of their revenue from coal production by mid-2020. (* figures are as at 31st December 2020)

On much of this, the investment industry has been running ahead of the regulator, meeting market demands for a greater focus on ESG. However, the market has not been able to agree on common definitions, resulting in fragmentation. Ultimately, regulators will need to intervene.

Investors are sending strong signals that they are unsatisfied with asset managers ESG criteria and disclosures. For instance, big names such as Morgan Stanley and Vanguard have been denounced for their “sin” stocks. Morgan Stanley Global Brands Fund had 6.83% in Philip Morris, its third largest holding, compared to 0.29% in the benchmark. The allocation comes despite the fact that the investment policy explicitly states the fund incorporates ESG considerations into its approach. The Vanguard SRI European Stock Fund did not have any tobacco exposure but was also criticized for its 5.7% allocated to alcohol, gaming and defense stocks.

When questioned about their ESG criteria, some asset manager respond that they want to maintain a “seat at the table” with companies that do not score well on ESG metrics, that ESG does not equal ethical investment, or that their specific methodology does not reject a given product. Some investors might question such approaches, but from managers’ point of view, they carry potential for gains, both environmentally and financially.

A Vanguard spokesperson said: “There are different flavors to socially responsible investing. Investors should look closely at a fund’s methodology and exclusion policy to ensure it matches their beliefs.”

In their current form, ESG policies seem to be lacking two core elements: first, a universal consensus on what constitutes an ESG investment and a way for asset managers to assess ESG compliance in their portfolio; and second, reporting on ESG is still non-coercive and even if it were, without a proper framework, these policies remain inefficient.

To demonstrate the ineffectiveness of current regulations, we turn to the EU, leaders in ESG regulations, to get an idea of current world standing in ESG policies.

In terms of ESG compliance, the EU has been working on creating ESG and climate change standards by deploying a Technical Expert Group on sustainable finance (TEG). However, most guidelines are still voluntary, non-legislative and unbinding for now. The current proposals include:

– An EU green bond standard: The TEG proposed that the Commission creates a voluntary, non-legislative EU Green Bond Standard to enhance the effectiveness, transparency, comparability and credibility of the green bond market and to encourage the market participants to issue and invest in EU green bonds. In 2019, the TEG published a report on EU Green Bond Standard.

– EU taxonomy: On June 2019, the TEG published a report on EU Taxonomy that sets out the basis for a future EU taxonomy in legislation. However, this report only tackles the climate change area of ESG.

– Benchmark: The TEG has been working on recommending minimum technical requirements for the methodologies of the “EU Climate Transition” and “EU Paris-aligned” benchmarks, with the objective to address the risk of greenwashing (greenwashing refers to marketing that portrays an organization’s financial products, activities or policies as producing positive environmental outcomes when it is not the case). As part of its mandate, the TEG also worked on recommending the alignment with the Paris agreement and ESG disclosure requirements, including a standard format to be used to report such elements.

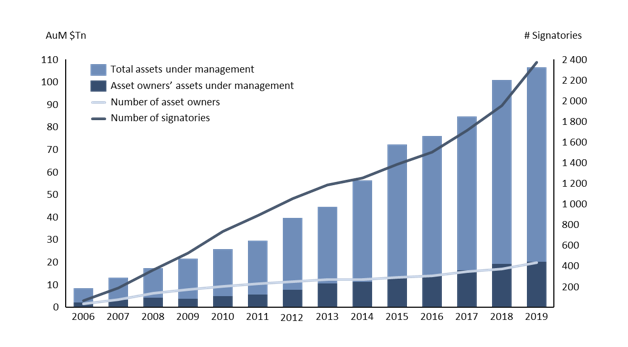

Nonregulatory bodies have also been looking for solutions to help companies audit green conformity and provide companies with step by step instructions , such as the UN PRI. Signatories of the UN PRI recognize the potential impact of ESG issues on the performance of investment portfolios, they acknowledge that in order to be effective fiduciaries, they must integrate these factors into their investment analysis, seek appropriate disclosures, and incorporate ESG issues into their ownership and voting practices.

As per ESG reporting, it is also still voluntary in most EU countries except for France which has made it mandatory for asset managers and institutional investors to report on how ESG are incorporated in their investment and risk-management processes with specific mention on climate change considerations (Article 173 of French Law on energy transition for green growth), and the Netherlands, where pension plans are required to disclose in their annual report if ESG criteria are incorporated.

Reporting guidelines were only published recently in 2019 by the TEG and they provide non-binding advice to help disclose climate change mitigation investments and activities.

In order to express their frustration, 631 institutional investors with more than $ 37 trillion in assets organized the largest ever joint call for climate change to governments during the 2019 COP 25 in Madrid. These investors wrote and signed a petition reiterating their full support for the Paris agreement and urging all governments to implement the actions that are needed to achieve the goals of the Agreement, with the utmost urgency.

To conclude, it has become clear that regulations that govern ESG are still insufficient. The introduction of such regulations will be beneficial threefold: First for investors as they deserve more transparency, second for asset managers to simplify the current disclosure standards that are both confusing and expensive for them and to renew their trust with their clients, and third and most importantly for the greater good of society and the planet.

Afaf Zarkik – Senior Analyst at Infomineo

Sources:

A sea of voices, Evolving asset management regulation report, KPMG, June 2019, https://assets.kpmg/content/dam/kpmg/xx/pdf/2019/06/a-sea-of-voices-eamr2019.pdf

Action Plan on Sustainable Growth”, European Commission, August 3rd, 2018 https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52018DC0097&from=EN

Climate action in Financial institutions, https://www.mainstreamingclimate.org/initiative/

Climate change and Green finance: summary of responses and next steps, FCA , October 2019, https://www.fca.org.uk/publication/feedback/fs19-6.pdf

ESG Investing 2.0: Moving Toward Common Disclosure standards, State Street, February 2020, https://www.statestreet.com/content/dam/statestreet/documents/Articles/1369%20ESG%20Metric%20and%20Reporting%20Standards.pdf

ESG: Understanding the issues, the perspectives and the path forward, PWC, February 2019, https://www.pwc.com/us/en/services/assets/pwc-esg-divide-investors-corporates.pdf

EU technical exert group on Sustainable finance, report on climate related disclosures, January 2019, https://ec.europa.eu/info/sites/info/files/business_economy_euro/banking_and_finance/documents/190110-sustainable-finance-teg-report-climate-related-disclosures_en.pdf

EU technical exert group on Sustainable finance, Report on EU green bond standard, June 2019, https://ec.europa.eu/info/sites/info/files/business_economy_euro/banking_and_finance/documents/190618-sustainable-finance-teg-report-green-bond-standard_en.pdf

EU technical exert group on Sustainable finance, Report on EU green bond standard – summary , June 2019, https://ec.europa.eu/info/sites/info/files/business_economy_euro/banking_and_finance/documents/190618-sustainable-finance-teg-report-overview-green-bond-standard_en.pdf

EU technical exert group on Sustainable finance, Taxonomy technical report, June 2019, https://ec.europa.eu/info/sites/info/files/business_economy_euro/banking_and_finance/documents/190618-sustainable-finance-teg-report-taxonomy_en.pdf

European Commission, Technical expert group on sustainable finance (TEG), https://ec.europa.eu/info/publications/sustainable-finance-technical-expert-group_en

Europeans make record investments in sustainable funds, Chris Flood, Financial Times, January 2020, https://www.ft.com/content/c2952357-c28b-4662-a393-c6586640404f

FCA urged to take action as investment industry shamed for greenwashing, Portfolio Adviser, November 4th 2019, https://portfolio-adviser.com/fca-urged-to-take-action-as-investment-industry-shamed-for-greenwashing/

Guidelines on certain aspects of the MiFID II suitability requirements, European Securities and Markets Authority (ESMA), May 2019, https://www.esma.europa.eu/system/files_force/library/esma35-43-869 _fr_on_guidelines_on_suitability.pdf?download=1

Investment Stewardship and the asset manager of the future, Legal & General Investment Management America, March 2020, https://www.lgima.com/landg-assets/lgima/insights/esg/esg-stewardship-and-the-asset-managers-of-the-future.pdf

Monstrous run for responsible stocks stokes fears of a bubble, Financial Times, Temple-West, P., February 20, 2020.

New business surges at Legal & General Investment Management, Financial Times, March 4th 2020

Regulating the growth of ESG Investing, A look at the landscape of ESG regulation around the world, across three main areas, Morningstar, June 3rd, 2019 https://www.morningstar.com/blog/2019/06/03/esg-regulation.html

The Evolving Approaches to Regulating ESG Investing, Morningstar, June 3rd 2019

The Pension Protection Fund (Pensionable Service) and Occupational Pension Schemes (Investment and Disclosure) (Amendment and Modification) Regulations 2018, October 1st 2019, http://www.legislation.gov.uk/uksi/2018/988/regulation/4/made

The Pension Protection Fund (Pensionable Service) and Occupational Pension Schemes (Investment and Disclosure) (Amendment and Modification) Regulations 2018 full PDF, made 10th September 2018 http://www.legislation.gov.uk/uksi/2018/988/made/data.pdf

US Forum for sustainable and Responsible Investments, https://www.ussif.org/index.asp

You may also like

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235