Five Charts Highlighting the Impact of Covid-19 on the Nigerian Economy

Eight months after Nigeria recorded its first Covid-19 case on February 27, the country has so far escaped the dire public health predictions made at the onset of the pandemic. As of October 26, 2020, there have been 62,111 confirmed cases and 1,132 deaths in Nigeria. (1,295,541 confirmed cases and 29,191 deaths in all of Africa). Back in March, health policy experts expressed serious concerns on whether African countries could limit the spread of the highly infectious coronavirus. One of the epidemiological models developed in March projected that by the end 2020, there would be an estimated 123 million infections and over 300,000 deaths on the African continent, in a best-case scenario. (1.2 billion infections and 3.3 million deaths in a worst-case scenario).

“A mix of socio-ecological factors such as low population density and mobility, hot and humid climate, lower age group, interacting to accentuate their individual effects”, have so far contributed to the relatively low level of infections and deaths recorded in Africa, according to the World Health Organization (WHO). Yet, as countries across the continent have eased lockdown restrictions which were crucial in limiting the spread of the coronavirus, experts have warned that African countries are not completely out of the woods, and must be vigilant to make sure that a second wave of infections does not overwhelm the continent’s weak healthcare systems.

So far, while Nigeria has avoided a public health crisis, on the economic front, the pandemic has disrupted lives and caused economic insecurity and hardship for households, affected business activities, and severely impacted the government’s finances. The five charts below illustrate the economic impact of the pandemic.

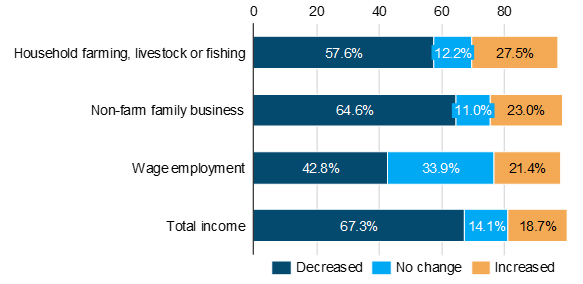

Impact on Livelihoods

As the country resorted to a lockdown to curb the spread of the coronavirus, the resulting slowdown in economic activities has taken a hard toll on Nigerian households. Earlier this year, due to restrictions on movement and travel, many of the country’s mostly informal 41.5 million Micro Enterprises (96% of all businesses in the country) which account for more than 80% of total employment, had to either close or scale back operations. The charts below show the impact of the pandemic on employment and income.

Source: National Bureau of Statistics (NBS) COVID-19 National Longitudinal Phone Survey Round 3: July 2020; Living Standards Measurement Study (LSMS) Integrated Surveys on Agriculture: General Household Survey Panel 2010/2011, 2012/3013, 2015/2016 and 2018/2019. Note: Round 3 of the Nigeria COVID-19 National Longitudinal Phone Survey (COVID-19 NLPS) 2020 was conducted between July 2 and July 16, 2020. 1,950 households from the baseline survey (Round 1) were contacted and 1,820 households, fully interviewed. According to the NBS, the data are representative at the national level and survey weights were calculated to adjust for non-response and under-coverage.

- Numbers do not add up to 100%

Source: National Bureau of Statistics (NBS) COVID-19 National Longitudinal Phone Survey Round 4: August 2020.

Note: Round 4 of the Nigeria COVID-19 National Longitudinal Phone Survey (COVID-19 NLPS) 2020 was conducted in August 2020. 1,881 households from the baseline (Round 1) were contacted and 1,789 households, fully interviewed. According to the NBS, the data are representative at the national level and survey weights were calculated to adjust for non-response and under-coverage.

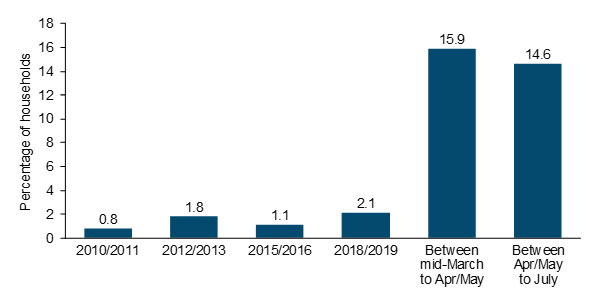

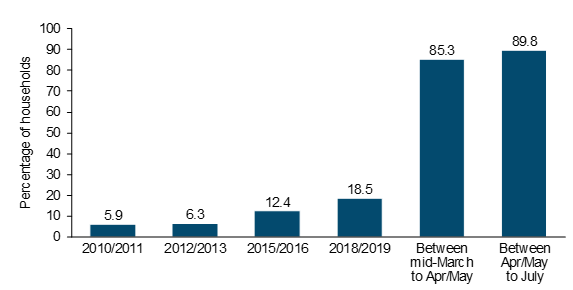

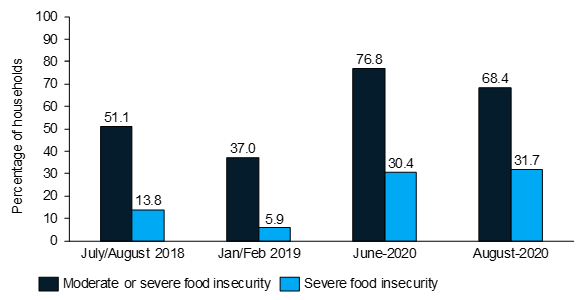

Food Insecurity

Since the pandemic began, the rates of moderate or severe food insecurity among Nigerian households have increased significantly. For most households, reduced incomes due to business closures and job losses, has coincided with an increase in food prices.

The Food and Agriculture Organization (FAO) defines food insecurity as a situation that exists when people lack regular access to enough safe and nutritious food for normal growth and development and active and healthy life. This may be due to the unavailability of food and/or lack of resources to obtain food. Severe food insecurity is akin to hunger and defined as when people have run out of food and gone an entire day without eating at times during the year.

According to the National Bureau of Statistics (NBS) August 2020 Covid-19 impact monitoring report, 68% of Nigerian households experienced moderate or severe food insecurity in August, down from 76.8% in June and almost double the rate of 37% measured in the NBS Jan/Feb 2019 General Household Panel (GHS) post-harvest survey.

The charts below show that almost all households in the country have experienced the shock of the increase in food prices and reveals the disturbing rate of severe food insecurity experienced by households since the pandemic started.

Source: National Bureau of Statistics (NBS) COVID-19 National Longitudinal Phone Survey Round 3: July 2020; Living Standards Measurement Study (LSMS) Integrated Surveys on Agriculture: General Household Survey Panel 2010/2011, 2012/3013, 2015/2016 and 2018/2019.

Note: Round 3 of the Nigeria COVID-19 National Longitudinal Phone Survey (COVID-19 NLPS) 2020 was conducted between July 2 and July 16, 2020. 1,950 households from the baseline survey (Round 1) were contacted and 1,820 households, fully interviewed. According to the NBS, the data are representative at the national level and survey weights were calculated to adjust for non-response and under-coverage.

Source: National Bureau of Statistics (NBS) COVID-19 National Longitudinal Phone Survey Round 4: August 2020; Living Standards Measurement Study (LSMS) Integrated Surveys on Agriculture: General Household Survey Panel 2018/2019.

Note: Round 4 of the Nigeria COVID-19 National Longitudinal Phone Survey (COVID-19 NLPS) 2020 was conducted in August 2020. 1,881 households from the baseline (Round 1) were contacted and 1,789 households, fully interviewed. According to the NBS, the data are representative at the national level and survey weights were calculated to adjust for non-response and under-coverage.

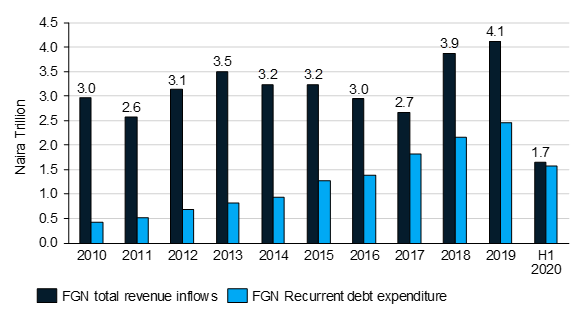

The Federal Government of Nigeria’s (FGN) Revenue Problem have worsened

The FGN’s finances has been hit with a double whammy of Covid-19 and low oil prices. The record crash in oil prices and the global spread of the coronavirus earlier this year prompted a downward review of the FGN’s overly ambitious revenue targets for 2020, which will see its fiscal deficit widen further. In its May 2020 Economic report, the Central Bank of Nigeria (CBN) noted: “If the current COVID-19-induced restrictions persists, and oil prices remain low, government revenue is likely to further decline. However, recurrent expenditure is projected to continue to rise, considering the countercyclical fiscal policy measures needed to sustain the economy. Consequently, the overall fiscal balance is expected to deteriorate further, while the Federal Government resorts to new borrowings to finance its increasing obligations.”

The Country’s Ministry of Finance echoed a similar message as from the CBN expressing worry about the state of the FGN’s finances noting that “The projected Debt Service/Revenue ratio at 47% (actual for 2019 was 58%) raises some concern about the sustainability of FGN debt. However, it is more indicative that the country is faced with a serious revenue problem rather than a classic debt problem. Efforts must therefore be geared towards tackling the revenue problem so it does not degenerate to a real debt sustainability issue.”

The chart below illustrates an increasingly worrying revenue problem for the FGN and shows total recurrent debt expenditure taking up a large chunk of total revenue inflows.

Source: Budget Office of the Federation, Federal Ministry of Finance.

Note: Recurrent Debt Expenditure includes debt service payments and line items such as interest on ways & means and sinking fund to retire maturing loans.

Sources:

- “CBN Economic Report, May 2020”, Central Bank of Nigeria, https://www.cbn.gov.ng/Out/2020/RSD/CBN%20Monthly%20Economic%20Report,%20May%202020.pdf, accessed 27 October 2020

- Covid-19 Impact Monitoring, National Bureau of Statistics, July and August 2020

- “Covid-19 in Africa: protecting Lives and Economies”, United Nations Economic Commission for Africa, https://www.uneca.org/sites/default/files/PublicationFiles/eca_covid_report_en_rev16april_5web.pdf, accessed 27 October 2020

- “Covid-19 Nigeria”, Nigeria Centre for Disease Control, https://covid19.ncdc.gov.ng/, accessed 27 October 2020

- “Hunger and food insecurity”, Food and Agriculture Organization of the United Nations, http://www.fao.org/hunger/en/#:~:text=A%20person%20is%20food%20insecure,an%20active%20and%20healthy%20life., accessed 27 October 2020

- “Social, environmental factors seen behind Africa’s low COVID-19 cases”, World Health Organization, https://www.afro.who.int/news/social-environmental-factors-seen-behind-africas-low-covid-19-cases, accessed 27 October 2020

- The Medium-Term Expenditure Framework and Fiscal Strategy Paper (MTEF/FSP) 2021-2023, Budget Office of the Federation, Federal Ministry of Finance, Budget & National Planning

- Quarterly Budget Implementation Reports 2010-2020, Budget Office of the Federation, Federal Ministry of Finance, Budget & National Planning

- “WHO Coronavirus Disease (COVID-19) Dashboard”, World Health Organization, https://covid19.who.int/, accessed 27 October 2020

You may also like

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235