Microinsurance sector : An overview of the market development and distribution strategies in Africa

Home to more than 700 million low-income citizens, Africa is considered a major market for micro-financial offerings, including microinsurance. According to the 2018 Landscape of Microinsurance in Africa study conducted by the Micro Insurance Network, only 2% of Africa’s low-income population is currently served by microinsurers.

Microinsurance at its core is a type of insurance offering designed for affordability and inclusivity. This means that microinsurance only targets low-income clients, who cannot access mainstream insurance services or equivalent government programs. Despite operating with the same revenue and business model as traditional insurance providers, microinsurance companies serve these marginalized populations by offering suitable coverages for specific types of risks in exchange for low premiums.

To better understand the microinsurance dynamics and progress in Africa, there needs to be a focus on two key elements. The first is the emergence of microinsurance and the type of products marketed in Africa, which will help categorize and explain the recent sector growth in the continent. The second point is the innovation in distribution channels, which highlights the type of efforts and initiatives made by microinsurance stakeholders to increase their profitability.

Microinsurance in Africa: Context of emergence

As a division of microfinance, microinsurance began to appear in the African market as a form of charity which was part of global financial aid programs introduced by international organizations. Other market players also started to offer cheap insurance policies to a specific type of clientele. These players include private insurers, mutual insurance companies and funds, microfinance institutions, NGOs, governments or semi-public bodies, etc.

Two key main factors drew some of these players to the microinsurance market in Africa. First, the great success that microfinance practices had in Africa, in addition to a relatively low competition level compared to the traditional insurance market. Second, there was a significant insurance gap that needed tailored products to answer certain types of risks that were not covered by traditional insurance offerings. This led microinsurance programs to focus on the following types of products:

-Credit life and life insurance, which respectively represent 26.2% and 15.1% of the total premium collected in 2017, are considered as the original microinsurance products developed in Africa. The domination of life and credit life insurance is due to the profitability that the products offer to the stakeholders as well as the flexibility of distribution of these products, that are often bundled with health and accident insurance policies.

-Funeral insurance products, account for 17.4% of the total premium collected in 2017 in Africa, and are particularly successful in Southern African countries, including Zambia, Namibia, South Africa, Malawi, and Zimbabwe. These policies can also be offered as part of a life insurance policy.

-Health insurance is another forefront microinsurance product which represents 25.5% of the total premiums collected. The product has been positively expanding in the African market over the past few years, and is provided through two main branches, either by supporting public coverage schemes or by directly offering complementary health products, such as hospital cash and health value-added coverages.

-Crop and livestock insurance’s percentage of total premiums collected in 2017 stood at 4.9%. The product maintains its steady growth as one of the major microinsurance products, often supported by government schemes. These schemes not only support the vulnerable population that needs micro agriculture insurance, but also help the private insurers face the higher claims ratios and costs structures caused by the distribution difficulties and climate challenges.

Innovative distribution channels for a more profitable microinsurance market

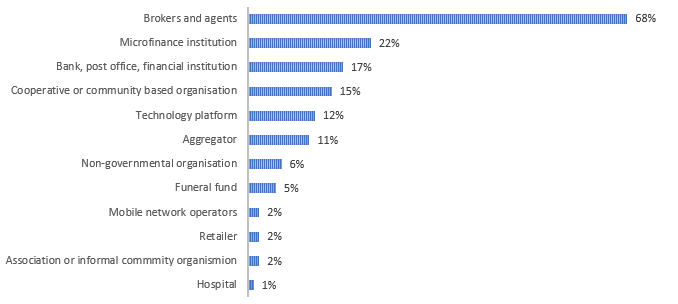

Microinsurance distribution channels in Africa are highly reliant on partnership models. 68% of microinsurance companies in Africa distribute their products using brokerage and agency channels. And 22% of companies partner with microfinance institutions to either directly sell the individual microinsurance policies or bundle them with other micro-financial products.

Proportion of microinsurance providers making use of each distribution channel type in 2017

In recent years, microinsurance has become an attractive segment for multiple insurance providers due to the high demand and overall potential profitability of the products. Consequently, this rush towards the market has led more stakeholders to launch new microinsurance products.

In addition to the rise in competition, micro insurers face another type of challenge related to policy costs. As previously defined, the microinsurance business model is based on low-premium policies. This pricing constraint has an impact on the policy costs that are not proportional to the policy value or type. In order words, micro insurers have to offer low-premium policies while taking into consideration the high costs of the underwriting and distribution processes.

To deal with this issue, microinsurance providers are gradually increasing the use of digital technologies and platforms in their processes. Moreover, microinsurers are also finding great value in Mobile Network Operator (MNO) partnerships that allow them to facilitate the distribution of the products while reaching new clients based in rural areas. For instance in Ghana, Tigo began offering a life insurance product that is bundled with the customers’ monthly cell phone subscriptions. The offering was developed in partnership with Bima, a Swedish company specializing in mobile insurance, Vanguard Life Assurance, a local insurer, and MicroEnsure, a specialist insurance provider. The basic insurance scheme allows customers to access free of charge life insurance for themselves and one family member. The insurance coverage also depends on how much airtime customers use in a month. In case customers want to upgrade their coverage, they can pay an extra monthly premium, which gives them additional life coverage for them and their families.

Partnerships with mobile money operators have also emerged as a new way for microinsurance companies to digitalize steps in the insurance value chain which include premium collection and claims payments. A major example of this is the microinsurance offering provided by telecommunications provider Safaricom and their leading mobile money solution M-Pesa. Safaricom established partnerships with several micro-insurers such as UAP Insurance, Britak, MicroEnsure, and GA Insurance. The microinsurance products offered include weather index insurance designed to insure and disbursement maize and wheat farmers, personal accident, life, disability, and health insurance products. Through these partnerships, microinsurance carriers can directly receive premium payments from the policyholders using M-PESA’s mobile money transfer service. In addition, policies management, monitoring, and adjustment processes are completed through FrontlineSMS and PaymentView, which are the integrated open-source software programs.

Technology-based integrations in the microinsurance experience seem to be a real opportunity for microinsurance providers to grow their business and reach more customers. According to a study from Cenfri, 277 unique digital platforms are operating in Ghana, Kenya, Nigeria, Rwanda, South Africa, Tanzania, and Uganda. And 20 of these platforms already integrate insurance products in their offerings.

Lastly, there is no doubt that microinsurance is a promising sector experiencing drastic growth across its operations as well as its innovation processes. And while costs constraints remain a major challenge for micro insurers, recent initiatives showcase the efforts undertaken by stakeholders to increase the reach and viability of micro-insurance as a standalone and profitable sub-sector.

Intissar Mounaji – Senior Analyst at Infomineo

Sources :

https://assets.kpmg/content/dam/kpmg/za/pdf/2017/08/microinsurance-in-africa.pdf

http://www.impactinsurance.org/sites/default/files/MP26%20v3.pdf

You may also like

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235