Results-Based Financing: An Innovative Financing Mechanism for Poverty Eradication in Developing Nations

Covid-19 has increased the number of poor people in the world

The COVID-19 pandemic has revealed stark inequities that are simultaneously acute and chronic. Even more so, it triggered a global humanitarian crisis, putting both lives and livelihoods at risk. According to the World Bank, global extreme poverty rose in 2020 for the first time in over 20 years as the disruption of the COVID-19 pandemic compounds the forces of conflict and climate change, which were already slowing poverty reduction progress. The estimated increase in global poverty in 2020 was truly unprecedented, with COVID-19-induced new poor estimated to be between 119 and 124 million.

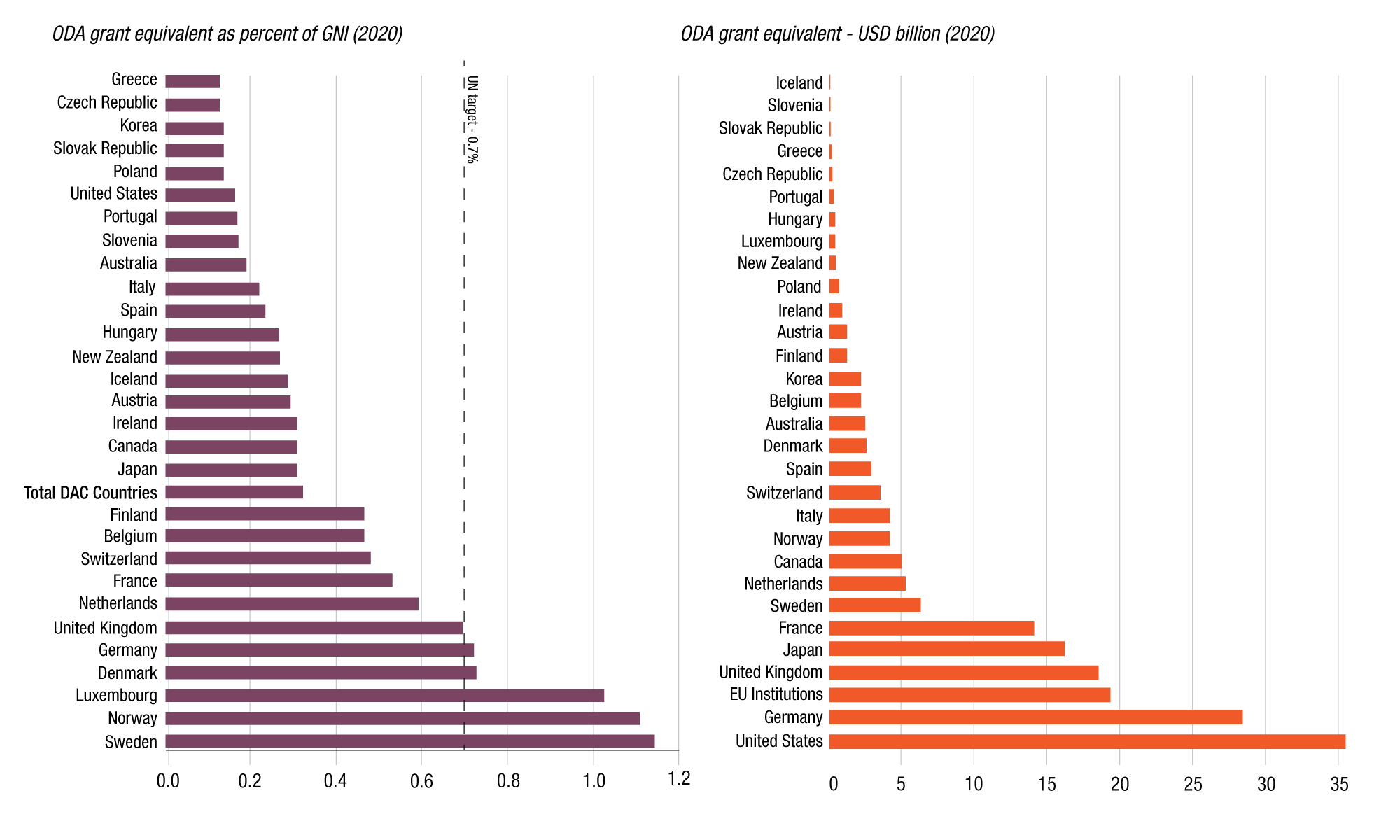

NGOs and governments have been particularly active and have stepped up to provide relief. These relief packages will continue to be important as the pandemic stretches out, with recovery likely to be a long-drawn process. Official development assistance (ODA) from members of the OECD’s Development Assistance Committee (DAC) rose to an all-time high of USD 161.2 billion in 2020, up 3.5% in real terms from 2019, boosted by additional spending mobilized to help developing countries grappling with the COVID-19 crisis. Bilateral ODA to Africa and least-developed countries rose by 4.1% and 1.8% respectively. Humanitarian aid rose by 6%.

The world is off-track to ending poverty in 2030

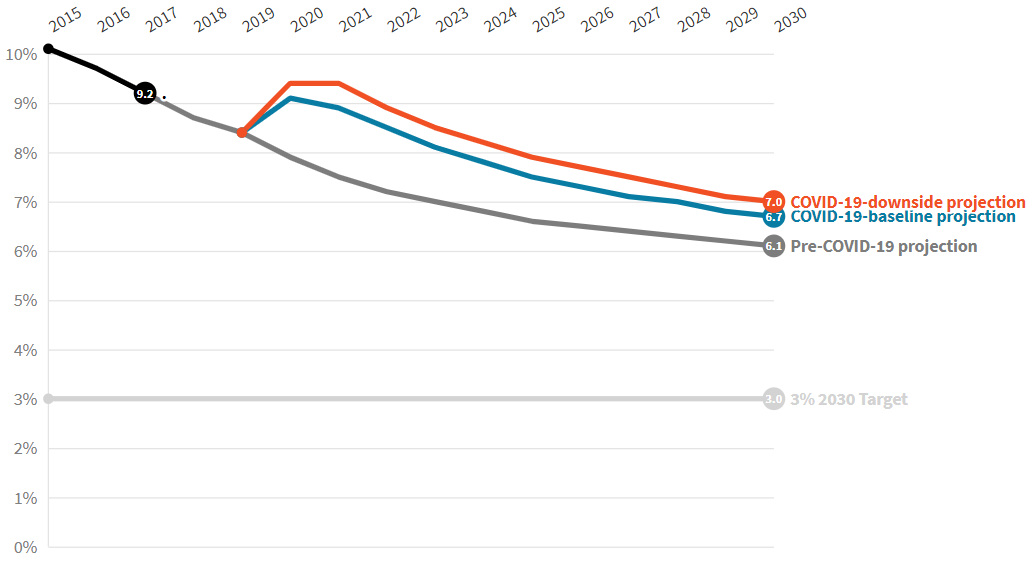

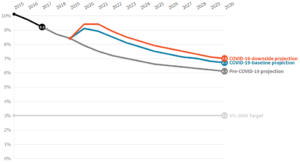

Poverty eradication, especially in developing countries, is one of the greatest challenges facing the world today, and an indispensable requirement for sustainable development. This explains why in 2015, the international community enshrined the aim of ending extreme poverty by 2030 in the Sustainable Development Goals. According to the most recent estimates, in 2019, 8.2 percent of the world’s population lived on less than $1.90 a day. Even before COVID-19, baseline projections suggested that 6 percent of the global population would still be living in extreme poverty in 2030, missing the target of ending poverty.

According to UN data, the share of the world’s population living on less than $1.90 per day was between 9.1% and 9.4% in 2020. These estimates are close to the global poverty rate of 9.2% in 2017, implying a three-year setback in the poverty reduction goals. Projected estimates for 2030 incorporating the COVID-19 pandemic suggest a 6-to-7-year setback in the poverty reduction goal relative to the projections without the pandemic. Accounting for COVID-19 suggests a global extreme poverty rate between 6.7% and 7.0% in 2030, which translates to between 573 and 597 million poor people. This suggests that the COVID-19 pandemic is likely to set back progress towards the World Bank’s poverty goal by 6 to 7 years.

Aid and economic growth are not enough to end extreme poverty

Historically, the quest to reduce poverty has relied on two levers: economic growth and the intentional redistribution of resources to the poor, either by the domestic state or foreign aid. Lucy Page and Rohini Pande (“Ending Global Poverty: Why Money Isn’t Enough, 2018” published by Journal of Economic Perspectives) argue that growth and aid, at least as currently constituted, are unlikely to suffice to end extreme poverty by 2030. They added that the total volume of aid has increased substantially over time, rising nearly fivefold between 1960 and 2016, from about $32 billion to $158 billion in 2016—both in constant 2016 US dollars (OECD 2018). Indeed, if the cost of ending poverty were simply the dollar value of the shortfall between the poor’s daily consumption and $1.90, then the problem would appear to have been solved because official development assistance has exceeded this value since 2006.

Economic growth may not help reduce poverty because growth often discriminates. But poverty can have a long half-life in the presence of inequality. In India, which in 2013 contained the largest share of the world’s extremely poor, over 100 billionaires lived alongside 210.4 million people in extreme poverty. This imbalance arises from unequal growth. These trends in inequality suggest that growth does not reduce poverty as quickly as the equitable distribution of resources might permit.

Results-Based Financing (RBF) vs traditional funding mechanisms

The complexity and interconnectedness of the variables that drive poverty reduction and inclusion outcomes call for the use of different approaches other than the traditional approaches that have yielded very few results. To end extreme poverty sustainably and as quickly as possible, the states governing the world’s poor need to maximize finance for poverty eradication by leveraging innovative financing models that are both accountable to the needs of the poor and have the capacity to meet those needs.

Traditional development funding approaches, where payments are made based on inputs and activities have perpetuated unsatisfactory results. This is because traditional funding rewards implementers for delivering the activities of development programs according to pre-established plans and timelines and not based on the results or impact made by the intervention.

Results-based financing responds to these limitations through a simple but fundamental change in the way poverty reduction programs are funded: Shifting from paying for inputs and activities to paying based on measurable results being achieved and verified. RBF thus provides an additional guarantee of value for money compared to traditional funding. With RBF, payments are closely linked to the intended development results and hence bridge the gap between good intentions and results. By tying payments to results, RBF ensures that funding supports outputs or outcomes.

Results based financing is the way to go

In 2014, UNCTAD estimates that achieving the Sustainable Development Goals (SDGs) by 2030 will require $3.9 trillion to be invested in developing countries each year. It also notes that with an annual investment of only $1.4 trillion, the annual investment gap is $2.5 trillion. To fill this gap, countries have increasingly adopted results-based financing, or RBF, as an innovative and effective approach to funding poverty alleviation projects.

This approach (RBF approach) has risen to the challenge. In the last decade alone, at least $25 billion of development spending has been tied to results, an increase from just a few billion the decade before. This growth has largely been led by the World Bank with its Program-for-Results Financing (PforR) instrument involving $19 billion tied to results. The World Bank’s Global Partnership for Results-Based Approaches (GPRBA) has tested RBF approaches in Africa, South Asia, and other developing regions which has benefited around 11 million people in 30 countries, improving services for low-income communities in a range of sectors.

RBF is defined as a financing arrangement in which payment is contingent upon the achievement of predefined and subsequently verified results. To help eradicate poverty and ensure that no one is left behind, governments and donor groups can use results-based financing (RBF) approaches which can catalyze social impact for long-term structural change.

RBF ensures that development funding is linked to pre-agreed and verified results, and that funding is provided when the results are achieved. Through a range of mechanisms, RBF drives both innovation and efficiency by aligning incentives to the welfare of program beneficiaries, providing flexibility to maximize results, and enhancing the accountability of the incentivized agent to the beneficiaries. By putting a portion of the funding at risk, or providing a bonus payment, RBF promotes alignment between the interest of the funder, the incentivized agent, and the welfare of the beneficiaries. It does so by rewarding the incentivized agents financially for delivering results, thus compelling them to implement activities that meet the beneficiaries’ needs.

Evidence of the effectiveness of RBF

Whilst the practice of RBF remains nascent, there is overwhelming evidence of its impact. In Burkina Faso, Trickle Up partnered with community-based organizations to deliver its program under a results-based financing model. The program is based on the graduation program, which combines seed capital, savings, skills training, coaching, confidence-building, and social support. Since 2007 Trickle Up has implemented the Graduation approach with approximately 5,450 households, effectively impacting over 27,000 beneficiaries.

Results show that the Trickle Up program has contributed to increasing households’ income and daily spending on foods other than grains by 3 times, increasing participation in savings to up to 99%, up from only 34% at baseline, supporting the creation of livelihoods with 65% of participants in Burkina Faso reporting having two or more businesses, increasing the resilience of participant households to environmental shocks and market trends.

As the number of poor people increases due to the COVID-19 pandemic with its resultant effect of more funds needed to eradicate poverty. Now more than ever is the time to use innovative financing models such as RBF to finance poverty alleviation projects to make sure that the desired results are achieved with limited resources deployed. Much progress has been made but much more is still required.

Author: Jonathan Sumbobo

Sources

https://sustainabledevelopment.un.org/content/documents/3770chapeau_clean.pdf

https://mappingignorance.org/2018/12/19/when-money-is-not-enough-to-help-the-poorest/

https://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.32.4.173

https://sdgs.un.org/goals/goal1

https://www.instiglio.org/impact/trickle-up-performance-based-contract-design-in-burkina-faso/

https://trickleup.org/wp-content/uploads/2020/03/OurWorkBurkinaFaso_2016_10.pdf

You may also like

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235