The Evolving Global Crypto-Ecosystem

Modern crypto assets offer fast and simple payments, innovative financial services, and access to untapped markets and un-banked parts of the world. All these innovations are made possible on account of the fast-evolving crypto ecosystem. However, the rapid growth and adoption of crypto assets have led to new risks and challenges.

The Growth of Crypto Assets

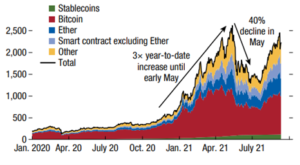

The market capitalization of crypto assets has registered substantial growth in recent years, albeit it amid large bouts of price volatility. In 2021, it increased three-fold compared to October 2020 reaching a record high of $2.5 trillion in early May. Concern from institutional holders on the influence of crypto assets on the environment, along with heightened global regulatory scrutiny led to a 40% decrease at the end of May, but the market value of crypto assets has since increased again, reaching more than $2 trillion by October 2021 — a 170 percent increase year to date. Numerous factors have played a role in the recovery of the crypto-assets market, most notably increasing interest from investors and consumers in decentralized finance (DeFi), Stablecoins, and “Smart Contract” blockchains.

Decentralized Finance (DeFi)

Decentralized Finance is a blockchain-based open alternative to the current financial system that does not rely on financial entities such as banks, brokerages, or exchanges to provide traditional financial instruments, relying instead on smart contracts on blockchains such as Ethereum. The DeFi market size reached $110 billion in September 2021, up from just 15 billion at the end of 2020, due largely to the growth of decentralized exchanges that allow users to trade cryptos without resorting to an intermediary, and credit platforms that allow lenders to access borrowers without the need to undergo a credit risk evaluation.

Stablecoins

Most DeFi services are built on the Ethereum blockchain and use Ethereum-based tokens, including stable coins. Stablecoins are a form of cryptocurrency that is designed to provide price stability, by anchoring their value to a specific asset. While this is typically the US dollar, it can also include commodities such as gold or oil, or simply other fiat currencies. In 2021, the market capitalization of stable coins grew to more than $120 billion, a four-fold increase over 2020. The largest of these, “Tether”, saw its market share gradually decline as leading crypto exchanges such as USD coin by Coinbase and USD Binance introduced their own versions to the market. According to the IMF, the trading flows of Stablecoins outstrip all crypto assets, primarily because they are so usable for settlement of derivates and spot trades on exchanges. Moreover, their price stability continues to improve, protecting users from the volatility of other crypto-assets and in so doing encouraging them to keep their funds inside the crypto ecosystem.

“Smart Contract” blockchains

Smart contracts are computer programs or transaction protocols that are executed automatically when a set of conditions are met. They are used to automate the execution of a contract so all parties involved can be confident of the outcome without time loss or the need to rely on an intermediary.

While Bitcoin remains the leading crypto asset in 2021, it has seen its market share decrease from 70 percent to less than 45 percent. The main reason behind this decrease is the shifting market interest towards more recent blockchains that operate smart contracts offering features that ensure sustainability, interoperability, and scalability. Ether, for instance, saw its trading volumes surpass those of Bitcoin earlier this year.

Challenges Posed by the Crypto-Ecosystem

The crypto ecosystem’s rapid growth has encouraged the entrance of new players and entities, many of which have poor cyber risk management, operational and governance frameworks.

Cyber risks

These include cases of hacking thefts of customer funds and the most common target centralized elements of the ecosystem, such as exchanges and wallets, though they have also been carried out against the consensus algorithms underpinning all crypto operations.

Operational Risks

These include failures and disruptions that prevent the use of services, leading to significant downtime and losses of customer funds. Such failures typically occur during periods of high transaction activity and are usually attributable to inadequate system and control design.

Governance risks

These encompass the lack of transparency regarding the issuance and distribution of crypto assets and have resulted in significant investor losses.

Noteworthy examples of such risks include the hacking thefts of Coincheck in 2018, and KuCoin in 2019 — in Japan and Singapore respectively — and the sudden price collapse and rapid outflows from Bitmex in 2020. More recent examples include the temporary shutdown of the Philippines Digital Asset Exchange and the collapse of Turkish exchanges Vebitcoin and Thodex, all of which took place this year.

Cryptoization

In emerging markets, the advent of crypto assets brings with it heightened macro-financial risk, primarily in the form of asset and currency substitution, or ‘cryptoization’. Cryptoization can negatively impact such economies in several ways, with perhaps the biggest risk coming from its tendency to reinforce dollarization forces, impeding the ability of central banks to implement effective monetary policy.

Looking Forward

While the above-mentioned crises did not have a substantial impact on global and domestic financial stability, the macroeconomic impact of such risks will only increase as the crypto ecosystem continues to expand. According to the IMF, regulators can mitigate these risks by enhancing their monitoring of crypto-assets through targeting data gaps in the market, while policymakers can do the same by implementing global standards for crypto assets. As Stablecoins continue to gain prominence, regulations will have to increase in accordance with the economic functions they perform and the risks they present. This will be especially important in emerging and developing markets — where the macro-criticality of Stablecoins can be considerably higher. Finally, emerging markets threatened by cryptoization should reinforce their macroeconomic policies and consider the benefits of issuing central bank digital currencies.

Author: Yassine Falk

Sources:

https://www.pwc.com/us/en/industries/financial-services/library/cryptocurrency-evolutiohtml

https://www.firstposcom/business/imf-warns-rapid-growth-and-increasing-adoption-of-crypto-

assets-pose-financial-stability-challenges-1001865html

https://www.imf.org/-/media/Files/Publications/GFSR/2021/October/English/ch2.ashx

You may also like

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235