The Gig-Work platforms’ market sheds its skin to face COVID’s impact

Over the past year, we all noticed more family members, friends, and colleagues adopting gig-work as a lifebuoy to cope with the pandemic’s consequences. The market landscape expanded to reach different professions and sectors, offering both workers and businesses, help to absorb shocks. It is totally reasonable to expect that, since the pandemic impacted all economies, it also had a considerable impact on the supply and demand of Gig Platform’s market. However, the nature of this impact remains subject to debate.

A study conducted by Mastercard in 2019 sized the gig economy market at $248.3 billion with a projected annual rate of 17.4%. The market is forecasted to reach $455 billion by the end of 2023. With 40.7 million freelancers on digital platforms across the globe that generate $193 billion in gross volume and $127 billion in disbursements to freelancers.

From a demand point of view, analysts expected the COVID-19 pandemic to have two opposing effects on demand for online gigs, depending on the companies’ behavior towards emergency strategies. It can cause a reduction in demand if companies are cutting their use of Gig Work platforms to protect and show more loyalty towards coworkers. And on the other hand, companies might now favor online workers hired through platforms to cut costs.

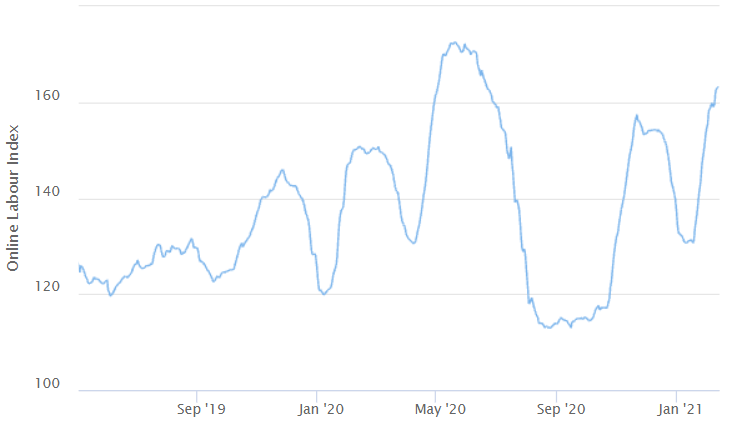

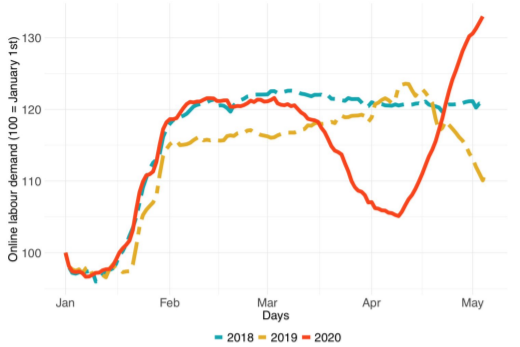

The iLabour project (the first online gig economic indicator, from Oxford internet institute) shows a fluctuation between both hypotheses. In fact, the pandemic affects gigs’ categories differently. But all faced a serious decrease last year (compared to 2019 & 2018, charts bellow), before recovering to previous optimistic levels.

These findings indicate that while the demand clearly soared due to a distancing effect, it also strongly disturbed the market’s seasonal pattern. In fact, in the previous years, demand used to slightly drop during the year-end holiday season, and then rises again from February up to May. Since the pandemic, the market experienced stronger volatility, suggesting that many online gig-workers will need urgent financial support to get through these crises.

The Online Labour Index (OLI)

The demand of online labour 2018-2020

Software development and tech gigs are taking the lead:

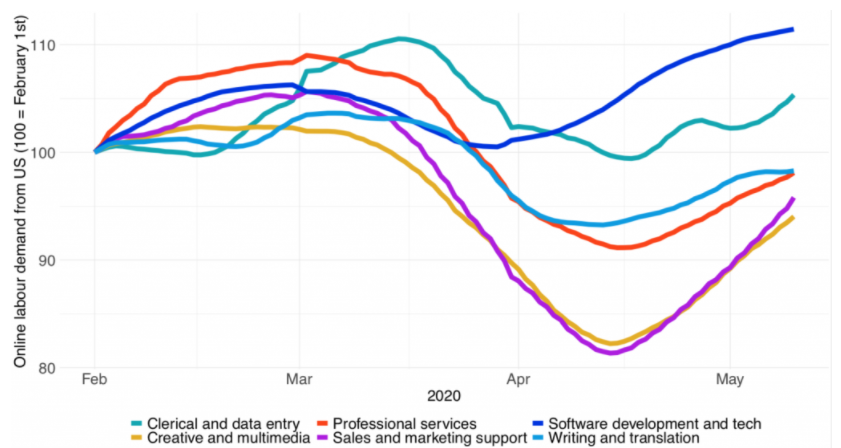

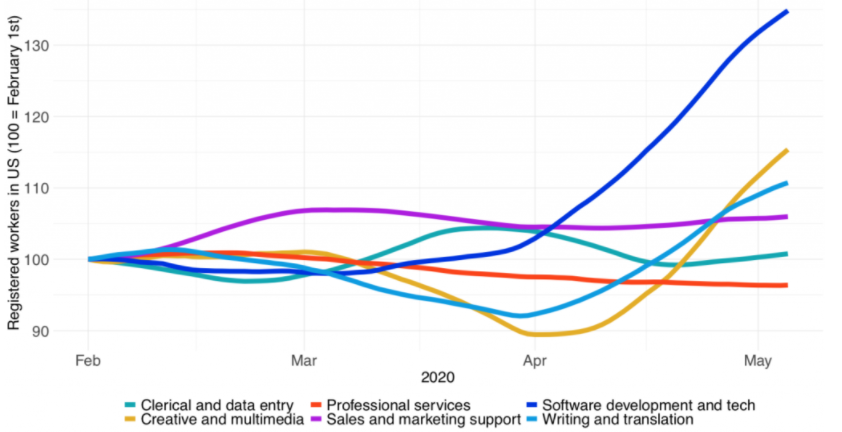

The market’s rebound is mainly due to software development and tech jobs that are currently most in-demand on Gig Work platforms, such as: Blockchain developers, AI engineers … As the US represents the top player in Gig Economy, OLI’s project presented the evolution of its supply and demand during the first months of 2020, to track the pandemic’s impact. The charts below are showcasing the considerable and fast increase of the software segment, especially during the period where all remaining professions were affected. This category’s wages are also making the difference as they ranged during 2019, in Upwork for example, from $31 USD to more than $115 USD per hour.

US contribution to the online labor supply and demand by category

According to the Online Labour Index, US is leading by far the category with 37.3% of vacancies posted, followed by the UK and Canada (9% and 7%). While Africa is only representing 3.2%, even though digital skills count for 44% of its demand, which highlights the overall small contribution of the continent.

The supply of software development and tech gigs is led by Asian countries (75%) with India and Pakistan at the top. Followed by Europe (17%), North America (3%) and Africa (3%). This category only represents 26% of the African offering. Even if Egypt and Kenya are both in the top 15 suppliers of the online platform market, the technology segment account for only 39% and 8% of their offering, compared to 79% in Russia.

The findings above suggest that complete opposed outcomes are possible for each country since the future of business is still unstable. In the best-case scenario, the demand would increase and lead to higher revenue and more job security. However, the number of online workers is also increasing, which might lead to critical competition for jobs, employment uncertainty, and lower earnings.

One thing for sure, the coronavirus pandemic aggravates the risky nature of online gig work. Besides the income stability issue, COVID-19 is now highlighting the importance of the overall financial health and unemployment protection.

Platforms are conducting positive changes to assure workers’ financial health:

It goes without saying that the main services required by gig workers are access to loans and insurance, to manage their income and face future unforeseen situations. For this matter, all stakeholders should partner and work together to increase the penetration of financial products and services. Financial institutions, governments, and gig work platforms all have an important role to play in strengthening this market.

Some players, mainly in the shared-driving and food delivery market, have been working on this issue, targeting 2 major solutions:

Platforms partnering with financial solutions providers:

Income protection insurance and access to loans are 2 pillars for gig workers’ financial health. Unfortunately, financial institutions rarely consider lending to this category. The lack of earning traceability is a serious obstacle. Thereby, some platforms are stepping forward to help track the worker’s employment history:

- Uber signed a partnership with AXA in 2018 for a Partner protection insurance to protect workers from lost earnings.

- In Southeast Asia, Grab is partnering with insurance company Chubb that offers medical and accident insurance to drivers.

- Mobymoney, a fintech start-up, is teaming up with FastJobs to provide an interest-free credit line.

- Careem has partnered with MicroEnsure to facilitate Careem captains’ health insurance in Pakistan

- IOTalent collaborates with GigaCover that brings income protection insurance solutions designed for freelancers.

Platforms offering new integrated financial solutions:

- GoGet Malaysia is offering savings, insurance and financial management tools on its platform.

- Grab offers a package of financial services, including micro-credit, personal accident insurance and insurance against critical illness.

- Uber launched Uber Care in 2018 to provide easy access to micro-loans, life insurance, and family health insurance to drivers.

In addition to platforms and financial institutions’ initiatives, many governments are taking the lead to harmonize and regulate the Gig-Work Platform market landscape. The International Labour Organization’s Global Commission on the Future of Work is discussing the implementation of an international governance system for digital labor platforms. And many countries are currently studying the implementation of an online gig worker’s digital ID, to enhance safety and security, and regulate taxation. If all stakeholders put effort into developing this market, will the online gig work become the next norm?

References:

- The iLabour Project – Oxford Internet Institute 2021

- Mastercard, “The Global Gig Economy: Capitalizing on a ~$500B Opportunity”, May 2019

Sources:

- MasterCard, “THE GIG ECONOMY IN EAST AFRICA A gateway to the financial mainstream”, September 2020

- Fabian Stephany, Michael Dunn, Steven Sawyer, Vili Lehdonvirta (2020), “Distancing Bonus or Downscaling Loss? The Changing Livelihood of US Online Workers in Times of COVID-19”, Oxford Internet Institute.

- Cutean, A., Herron, C., Quan, T. (July 2020). Loading: The Future of Work: Worldwide Remote Work Experimentation and the Evolution of the Platform Economy. Information and Communications Technology Council (ICTC). Ottawa, Canada

- The UN Capital Development Fund, “The Gig Economy and Financial Health A snapshot of Malaysia and China”, December 2020.

- Techwire Asia, “Grab upgrades its finance stack with micro-loans for consumers, and more”, August 2020

- https://iotalents.com/blog/income-protection-for-freelancers/

- Uber, Partner Protection Insurance with AXA XL

- Technologytimes, “Careem Announces Captain Support Initiatives In COVID-19 Pandemic”, April 2020

- The Hindu Businesses line “Uber helps driver partners with Rs 35.6 crore micro-loans”, February 2020

- SAS, “Top Trends: Why Tax Administrators Are Adopting New Data and Analytics Strategies”, 2020

- ILO, G20 Employment Working Group, “Policy responses to new forms of work: International governance of digital labour platforms”, April 2019

You may also like

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235

Warning: Undefined variable $content in /var/www/sdomains/nexatestwp.com/infomineo.nexatestwp.com/public_html/wp-content/themes/infomineo/single.php on line 235